Most plan sponsors evaluate the pricing competitiveness of their pharmacy program the same way – by going out to bid for a new pharmacy benefits manager (PBM). But, running a bid process can be expensive and difficult to manage. Therefore, plan sponsors tend to avoid the process all together. PBMs use this to their advantage, fueling one of the most fundamental ways in which they make money: multi-year static pricing agreements.

For purposes of this article, a multi-year static pricing agreement is an arrangement between a PBM and a plan sponsor with a duration of three or more years with no opportunity for early termination or pricing adjustment. Such agreements are very common. Typically, they are price competitive in year one, but they tend to grow stale in later years either by design, or because the pricing does not adjust to market dynamics, or both.

Frequently, the first year of a multi-year static pricing agreement is very aggressive because the PBM knows that exceptional year-one pricing gives the PBM the greatest chance of winning the business. At the same time, the PBM also knows that any profit margin it loses with outstanding first-year pricing can be recouped over the duration of the agreement by taking advantage of market dynamics.

An example of a current market dynamic that has provided significant upside potential for PBMs is the recent dramatic increase in the Average Wholesale Price of many drugs. Indeed, this issue has made quite a bit of news. But, what has slipped under the radar is that in many cases these dramatic price increases have come with significant increases in the rebates paid by drug manufacturers to PBMs.

All plans will experience the weight of the pricing increases we’ve all heard so much about, but plans on multi-year static pricing agreements may not experience any of the mitigating effect that comes from the increased rebates. This leaves the PBM in a position to capitalize on a market dynamic and improve or recoup its margins.

Employers Health leverages nearly $1 billion in annual drug spend to command pharmaceutical pricing that is among the most competitive in the industry. But, Employers Health’s commitment to provide competitive pricing does not expire upon implementation. Employers Health annually negotiates pricing improvements with its PBM suppliers to adjust to market dynamics and ensure that groups participating in one of its PBM programs receive the most competitive pricing available during each and every year of their participation.

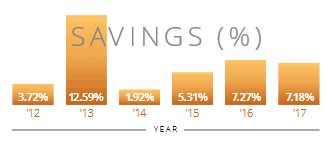

The table below shows the year-over-year pricing improvements (as a percent of total drug spend) Employers Health has secured for its participating groups through the pricing improvement process.

Because the pharmaceutical market is so dynamic, contracts between PBMs and plan sponsors must be nimble and adaptable to new market dynamics. A three-year static pricing agreement causes a plan sponsor to miss at least two valuable price improvement opportunities. Working with Employers Health ensures that a plan’s pricing is competitive upon implementation, and remains competitive each year thereafter.

Download Article