Obesity continues to be one of the most debated topics among plan sponsors. The question is no longer as simple as, “Should we cover anti-obesity medications?” It’s redefining obesity benefits to plan sponsors’ needs, while protecting the long-term financial stability of the plan. Glucagon-like peptide-1s (GLP-1s) aren’t going anywhere. New Food and Drug Administration (FDA) approved indications of GLP-1s and consumer weight loss stories are keeping these products at the forefront of members’ minds.

Anti-obesity medications continue to gain momentum

To fully understand where obesity treatment is headed, it helps to look at where it all began.

- In 2014, Saxenda (liraglutide) was the first GLP-1 to be approved for the treatment of chronic weight management, demonstrating a 7.4% weight loss from baseline.

- In 2021, a newer generation GLP-1 weight loss product, Wegovy (semaglutide), was approved.

- While sharing a similar mechanism of action to Saxenda, Wegovy offered more than double the weight loss (15%-16%).

- Wegovy’s approval marked the first notable weight loss medication to come to market. Since the launch of Wegovy, Zepbound (tirzepatide) received FDA approval for the treatment of chronic weight management at the end of 2023, offering even more weight loss in clinical trials (20.9%) and a slightly different mechanism of action.

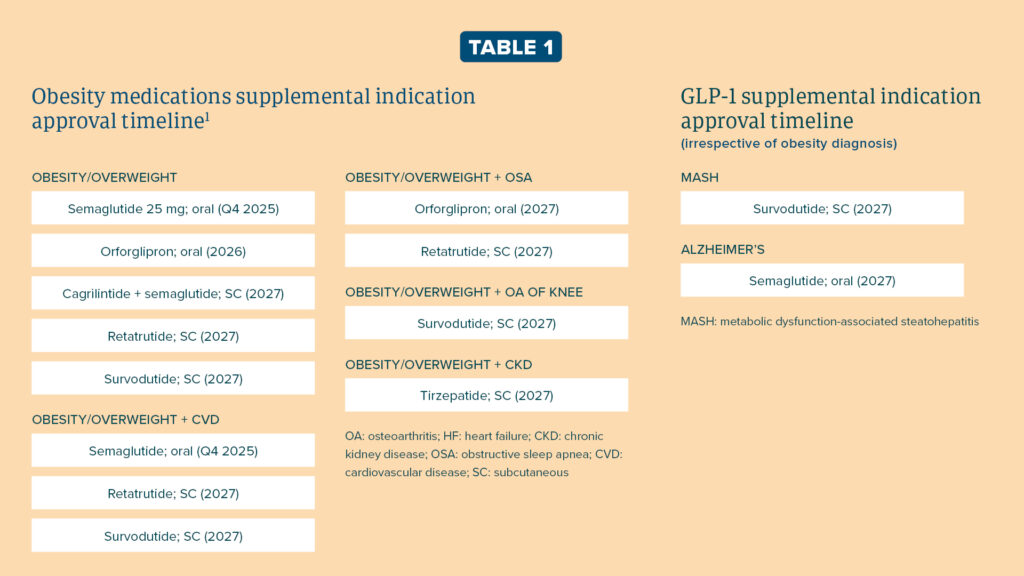

The pipeline is crowded with over a hundred medications in development for obesity treatment. By the end of 2025 and the beginning of 2026, it is expected that two oral products, semaglutide and orforglipron, will also gain FDA approval. For plan sponsors that cover obesity, these oral options may expand utilization with members who have been afraid to inject or have difficulty injecting medications.

Outside of the additional products expected to hit the market, there have been supplemental indication approvals for these medications. Wegovy has gained additional FDA-approved indications for the reduction of major adverse cardiovascular events in those with established cardiovascular disease (CVD) and obesity and for the treatment of a fatty liver condition, metabolic dysfunction-associated steatohepatitis (MASH). Zepbound has received an additional indication as the first and only medication to treat moderate-to-severe obstructive sleep apnea (OSA) in adults with obesity. These medications continue to prove their benefit in various conditions (TABLE 1).

Coverage decisions and utilization management opportunities

The latest report released from the Institute for Clinical and Economic Review (ICER)2 highlights that on an individual basis, therapies like semaglutide and tirzepatide may be considered cost-effective for the treatment of obesity. However, at the population level, even a 1%-2% uptake could be cause for concern around overall affordability and sustainability of the plan. Plan sponsors that do cover obesity are encouraged to explore more innovative plan designs that balance access with cost.

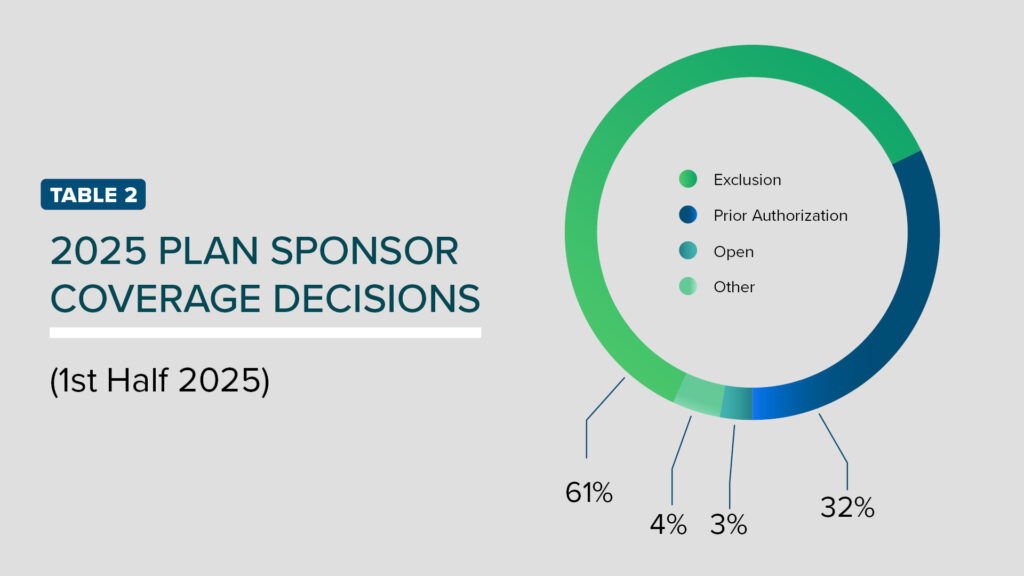

The most common form of utilization management includes prior authorizations (PAs). These PAs require lifestyle changes before and while using anti-obesity medication, require members meet a specific percentage of obesity medication and require members to meet a specific percentage weight loss from baseline for continuation of therapy. Over 70% of Americans now meet the body mass index (BMI) criteria of ≥ 27, raising concerns whether standard PAs are enough to maintain access to members while also balancing financial concerns. As such, 14 of our plan sponsors have decided to close coverage over the last 18 months (TABLE 2). Some plan sponsors have even considered excluding GLP-1s while retaining coverage for older weight loss agents.

Plan sponsors wanting to still offer coverage are looking for stricter criteria. Beyond more traditional measures of adjusting the BMI threshold to ≥35, some plan sponsors have elected to offer coverage for those with comorbidities, where the clinical benefits may be more pronounced (e.g., obstructive sleep apnea, reducing major adverse cardiovascular events or metabolic liver disease). Other plan sponsors have explored refill threshold adjustments, supply limits, increased cost sharing and maximum allowable benefits to manage utilization.

For a month’s supply of treatment, newer obesity medications can range from $1,000-$1,500. Refill threshold adjustments and supply limits help eliminate any stockpiling of medication or waste if members discontinue therapy, creating savings while preserving access. In contrast, increased cost-sharing may ease the financial burden on the plan, but can be a driver of low adherence. This raises the risk that employees will discontinue therapy before achieving clinically meaningful outcomes.

Alternatively, annual and lifetime maximum dollar limits are being heavily considered to cap employers’ financial risk. This approach assists employees during the beginning of their weight loss journey and aims to sustain their weight loss through lifestyle changes once the maximum funding is reached. However, a major concern with this approach is the continuity of care and the potential for weight regain upon discontinuation of therapy.

Weight management programs

There’s no one plan design that fits the needs of all of plan sponsors, but one solution has piqued plan sponsors’ interest this year: weight management programs. In a recent survey conducted by our clinical team, we found that there is an increase in lifestyle and wellness platform endorsements. Survey results showed that while weight loss PAs are still heavily relied on, more plans are adding requirements for wellness programs and nutritional counseling. These options seem to offer the best balance between maintaining the member experience and providing cost savings. Some plan sponsors have opted for drug coverage tied to participation in weight management programs, which has demonstrated more savings than a voluntary approach and requires that members make active lifestyle changes while on therapy.

- Anti-obesity medications are not just here to stay but are expanding. New options and additional indications can be expected in the next two years.

- The introduction of oral weight loss options will likely cause increased interest, utilization and spend.

- PAs aren’t always enough to keep costs down. Stricter criteria like electing coverage for those with comorbidities, refill threshold adjustments, supply limits, increased cost sharing and maximum allowable benefits are being explored by plan sponsors to mitigate costs.

While there is no universal approach to coverage, there are a multitude of opportunities available to plan sponsors to best fit their goals. The Employers Health clinical team is here to serve as a resource to inform and guide plan sponsors through these decisions to ensure they are making the ‘right’ decision for the plan and its members.

Please contact our clinical team at [email protected] to learn the best weight loss coverage options for your plan.