In a world where prices continue to rise, benefits professionals are left to face the ongoing challenge of balancing cost savings while still delivering high-quality care to members. One method to strike that balance is offering health plans with varying payment structures. The clinical team at Employers Health dug deeper to analyze the data to understand the impact on utilization and cost under two main plan types: preferred provider organizations (PPO) and high-deductible health plans (HDHPs).

What are the differences between a PPO and HDHP plan?

PPO plans tend to have lower deductibles and member cost share for health care expenses compared to HDHPs. While HDHPs do have higher costs for these categories, members often pay lower premiums. PPO plans have historically been the most popular offering from employers, but there has been a shift toward offering HDHPs over the last 20 years.1

One idea behind the promotion of HDHP plans is that a higher initial cost-share for a member may curb some spending for the plan. Many of these plans also qualify for a Health Savings Account (HSA), which alleviates some of the added cost to the members as they are able to use pre-tax dollars to cover eligible medical expenses. Despite this, there is some concern that members may avoid or delay care due to the increased cost share.

Insight into PPO vs. HDHP performance

Data from a large, self-insured employer within the Employers Health collective was analyzed to assess if plan design impacted member utilization of health care resources. The claims analyzed were processed between January 1, 2022, and December 31, 2023. Pharmacy data incorporated prescription claims data from the plan’s pharmacy benefit manager (PBM). Medical data included claims, services and costs of preventive screenings, office visits, hospitalizations and emergency room visits.

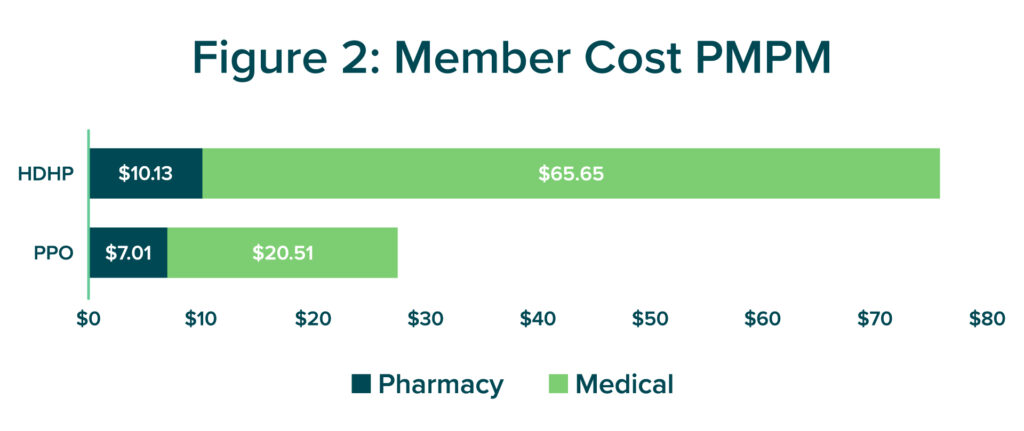

The results? For this plan sponsor, HDHP’s had less pharmacy-related costs per member per month (PMPM) than PPO plans (Figure 2). Members under the HDHP structure were younger, utilized their pharmacy benefit less often and filled more generic prescriptions than those covered under a PPO plan.

HDHP members also spent less PMPM on many first-line branded diabetic medications in glucagon-like peptide-1 receptor agonists (GLP-1) and sodium glucose cotransporter 2 inhibitor (SGLT-2) drug classes. Diabetes, blood pressure and cholesterol medication adherence rates were higher for PPO plan members despite the Affordable Care Act’s (ACA) mandated $0 copay for preventive medications, which included medications such as metformin, lisinopril and atorvastatin.

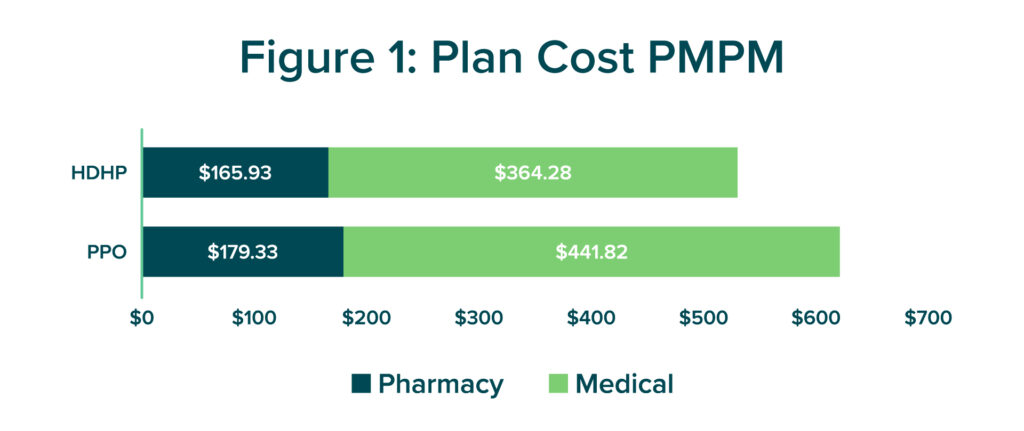

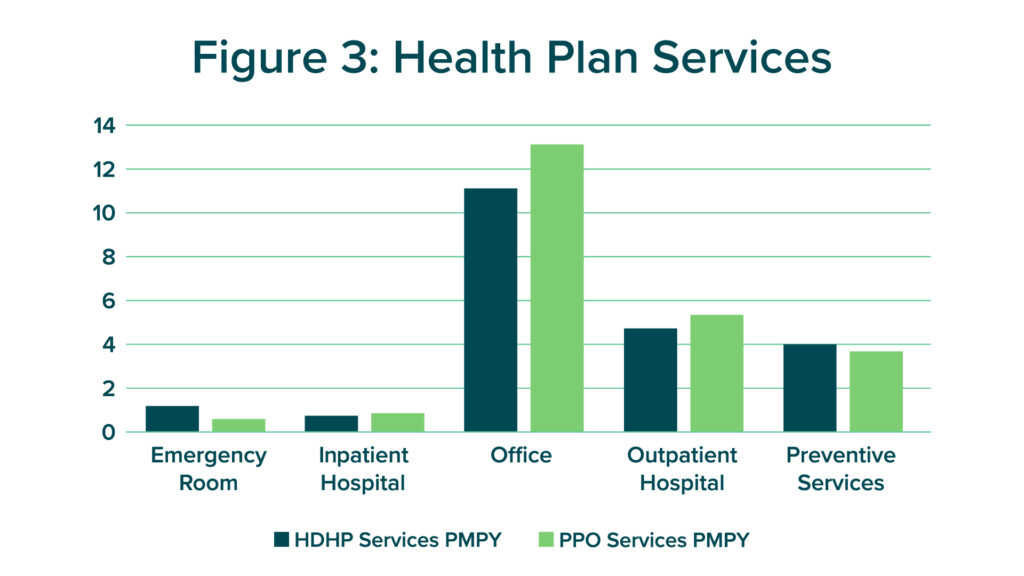

Medical spending PMPM for plan sponsors was also lower for HDHPs when compared to PPO plans (Figure 1). However, the total member spend PMPM for medical was significantly higher for HDHPs than PPOs (Figure 2). While HDHP members received more services in the emergency room than PPO members, members may have avoided receiving some services from inpatient hospitalizations, outpatient hospitalizations and office visits due to a higher cost share (Figure 3).2 The reduction in cost share for PPO members could have resulted in a greater willingness to receive non-urgent health care resources and prevent situations that would result in an emergency room visit. This may not have been the case for services that came at no cost, such as preventive services or screenings, which are also mandated by the ACA to be available at a $0 cost for plan members.

HDHP plan members also received slightly more preventive services per member per year (PMPY) than PPOs. A sub analysis of cancer screenings displayed that the two groups were screened at similar rates. With oncology being a common driver of spending for plan sponsors on both the medical and pharmacy side, it is encouraging to see that these groups have had similar rates of screenings when members have not incurred cost.

Plan sponsors have many options when deciding how to design their plan for members. Whether an HDHP or PPO plan design is the most cost-effective option should be carefully considered based on each plan sponsor’s unique needs and priorities. HDHPs may see greater initial savings due to a higher member cost share but could experience higher medical costs down the road if members are hesitant to seek care. However, member education about the availability of $0 preventive services may help reduce reluctance to utilize health care resources.

A plan that works for one organization may not work for another. Weighing the pros and cons of each plan type is essential to choosing the best plan for your members and their dependents. The Employers Health team is happy to support benefits teams as they navigate these differences in plan design to ensure high-quality care at a contained cost.